Asset managers should invest in their brand reputation.

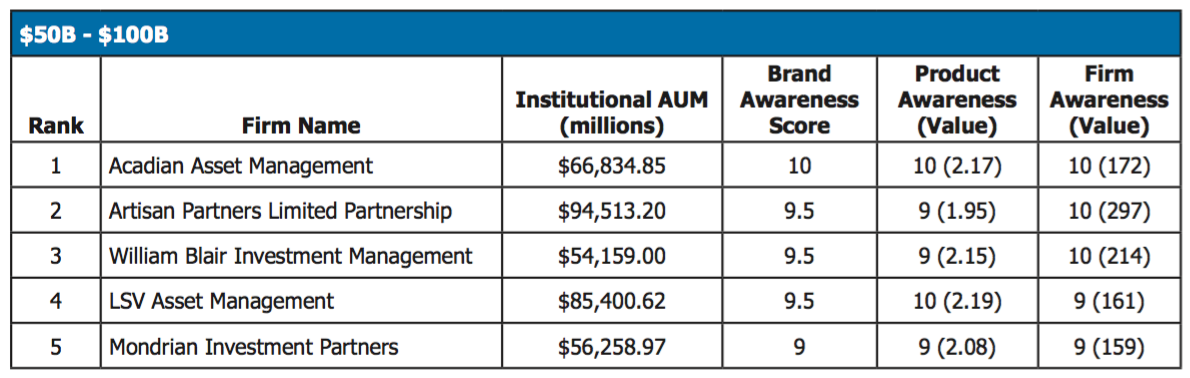

Data and analytics firm eVestment found high firm and product awareness—or together, brand awareness—could lead to greater retained assets and new inflows.

The research defined high brand awareness as a combination of the firm’s ability to “successfully garner attention across their product lineup,” as well as the ability to “leverage the consultant attention they receive across products.”

A study of managers with active equity and fixed income products from 2012 to 2015 revealed those with higher brand awareness realized growth nearly 24 times more than their low-awareness peers.

However, achieving this level of success on reaching a broad audience across multiple products is “extremely difficult,” eVestment said. Only 2.2% of managers were able to accomplish both high firm and product awareness; most only get one or the other.

“The average institutional consultant reviews less than two strategies per asset manager within a quarter,” the report said. “This small number signals that consultants and investors are likely searching for products agnostic of firm. It also clearly illustrates the challenge asset managers have in building brand awareness.”

Furthermore, eVestment found larger asset managers—and the higher number of offered products—“only marginally” increased their product awareness.

On average, asset managers with more than $100 billion under management had 57 actively managed strategies, while smaller managers with less than $1 billion had roughly 4 strategies. Consultants seek “a level of manager diversity in their allocation decisions and [this] speaks to the meritocratic nature of our industry,” according to eVestment.

However, brand awareness and perception can be a “double-edged sword” and can even incur negativity bias, the firm continued, as such recognition could hurt as much as help. For example, the study showed managers with the highest brand awareness averaged outflows 4.5 times larger than inflows.

“The loss of a star portfolio manager has a stronger impact than the hiring of an equally reputable star portfolio manager,” eVestment concluded. “It speaks to the importance of clear communication in containing and explaining potential drivers of negative perception which can be magnified by high brand awareness.”

Source: eVestment

Source: eVestment

Related: Reorgs, Reshuffles, Rethinks: Asset Management’s Overhauls