Newly formed hedge funds turned to lower fees and seed deals to attract investors in a challenging year for capital raising, an industry law firm reported.

More than two thirds of market entrants offered fee discounts in exchange for longer lock-up periods in 2015, according to a study of new hedge funds by Seward & Kissel. Additionally, 35% of equity hedge funds implemented tiered management fee structures, with rates decreasing as assets under management increased—up from 25% last year.

One fund even offered a tiered structure for incentive fees—the first to do so in the six years the law firm has been conducting the annual study.

“The 2015 study reveals a more even balance of power between hedge funds and investors,” said Steve Nadel, a Seward & Kissel investment management group partner. “More funds found it necessary to lure investors with reduced fees, but at the same time, investors understood that many strategies warranted a longer redemption cycle.”

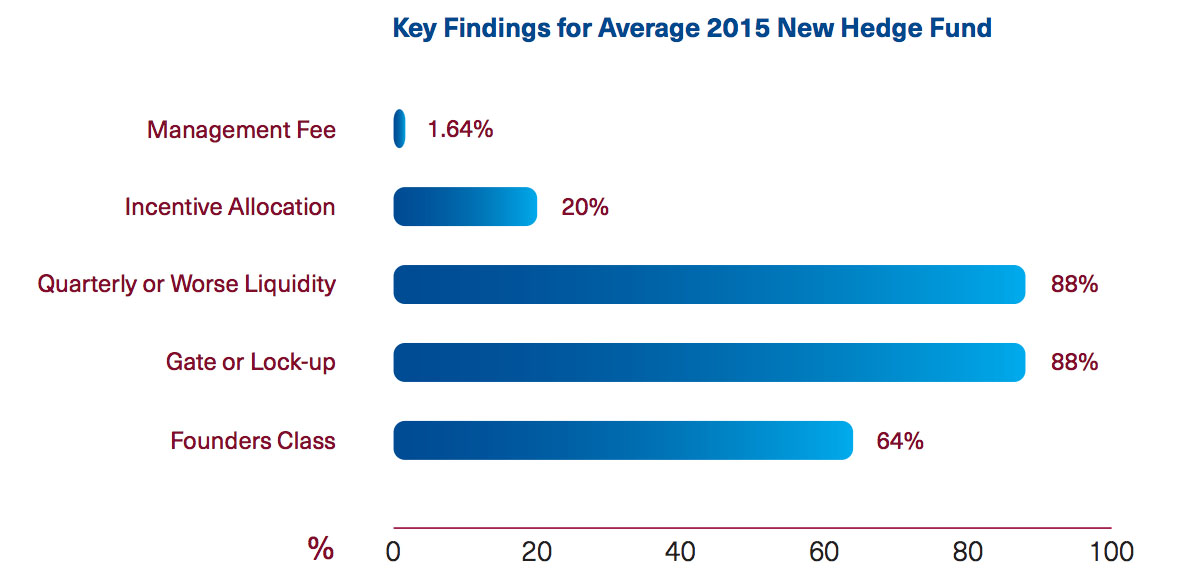

Management fee rates for new funds averaged 1.64%, a slight decrease from last year’s 1.7% average. Incentive fees, however, remained steady at the traditional 20% rate.

Equity strategies—by far the more popular offering in 2015, with four equity hedge funds for every non-equity fund—were the most expensive, with average management fees of 1.68%. Non-equity funds, meanwhile, charged management fees of 1.56%, a difference Seward & Kissell attributed to investor demand.

Of all funds, 64% offered founders classes, which included a management fee rate that was 50 basis points less than those charged in the flagship class, and incentive fees of 16%. As many as 82% of equity funds had founders classes, compared to just 29% of non-equity funds.

New hedge funds also looked to seed investments as a way of securing assets, with an estimated 35 to 45 seed deals occurring in 2015, according to Seward & Kissel. One-third of these investments were more than $50 million and a quarter totaled more than $100 million.

Source: Seward & Kissel’s “2015 New Hedge Fund Study“

Source: Seward & Kissel’s “2015 New Hedge Fund Study“

Related: Hedge Funds and the Price of Consistency & AUM Growth is Hedge Funds’ #1 Goal