Credit spreads have become critical to liability valuation and de-risking effectiveness—and hedging against that risk isn’t going to be easy, according to Cambridge Associates.

In a new research note, Senior Investment Director Alex Pekker argued that today’s environment—low interest rates, volatile spreads, demand for yield—has turned credit spread into an “increasingly material driver” of funded status risk for corporate pensions.

Particularly in the US, where credit spreads are a “substantial” component of liability valuation, Pekker said plan sponsors will need to take several steps to address this “complex and significant” risk.

“Theoretically, a ‘perfect hedge’ against credit spread risk would be a portfolio of Aa-rated corporate bonds matched to the duration and term structure of a pension’s liabilities,” he wrote. “In reality, however, the Aa universe is so limited and concentrated that investing in a 100% Aa-rated portfolio is both impractical and risky.”

Instead, the Cambridge Associates researcher suggested that plan sponsors diversify across the investment grade universe, balancing A- and Baa-rated credits with treasuries.

“A duration-matched portfolio composed entirely of credit is likely to have a moderately high tracking error to the liabilities, which are valued with Aa yields,” Pekker explained. “While such a portfolio is likely to out-yield the liabilities, it also is likely to be significantly more risky.”

Meanwhile, treasuries can extend portfolio duration and manage yield exposure with greater liquidity and lower transaction costs, he added.

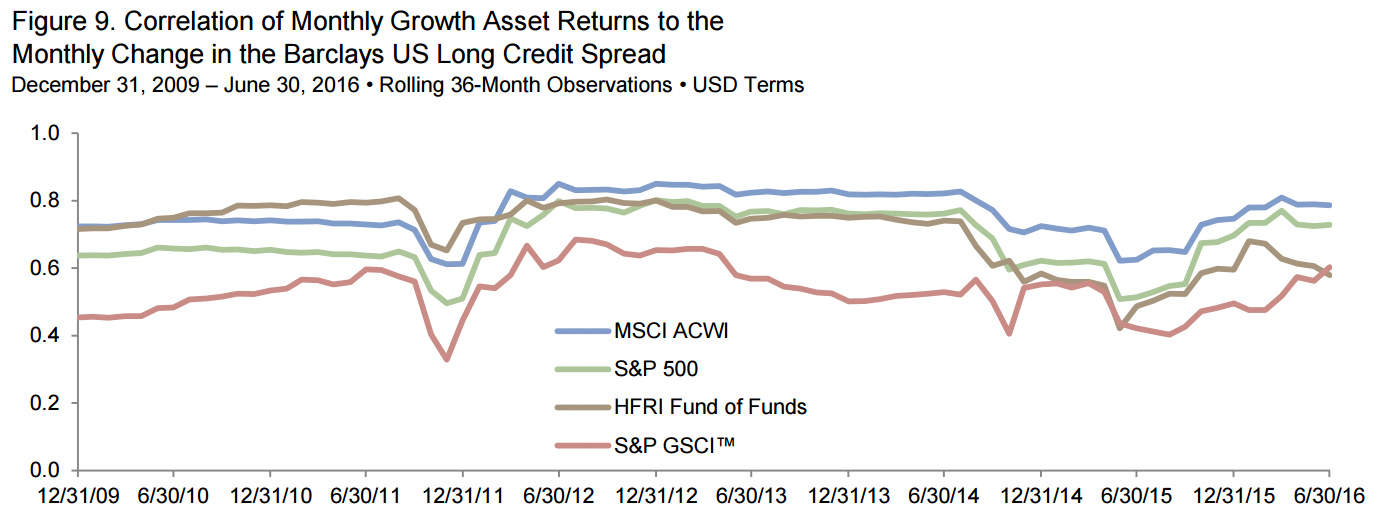

To ensure the spread hedge ratio stays at the desired level, Pekker said plan sponsors will need to actively manage the portfolio, adjusting credit allocations as spread betas vary over time. Spread exposure should also be considered on a total-portfolio basis, given correlations between long credit spreads and equities, hedge funds, and commodities.

“The growth portfolio… is implicitly hedging some of the liability credit spread risk, which is not captured in the spread hedge ratio,” he wrote. “Credit exposure within the liability-hedging portfolio should be lower when the allocation to growth assets is larger, and, conversely, higher when the growth allocation is smaller.”

Through active management and allocations to a mix of credit and government bonds, Pekker said plan sponsors can more effectively hedge credit spreads.

“Credit spread changes represent a material pension risk,” he concluded. “After interest rate risk, mitigating this risk should be of paramount importance.”

Source: Cambridge Associates’ “Don’t Forget the Credit Spread!”

Source: Cambridge Associates’ “Don’t Forget the Credit Spread!”