After the departure of two high-profile executives, an investigation by the US Securities and Exchange Commission, and a $200 million lawsuit, PIMCO—and its clients—were in need of some good news.

At the end of 2015, this good news arrived via PIMCO’s December performance report: The flagship Total Return Fund saw inflows of $1.3 billion—its first positive asset flow since April 2013.

“It speaks to the fact that things have kind of stabilized,” Morningstar Senior Analyst Eric Jacobson told CIO. “People who, for their own reasons, decided they wanted to leave the fund for the most part have probably already done so.”

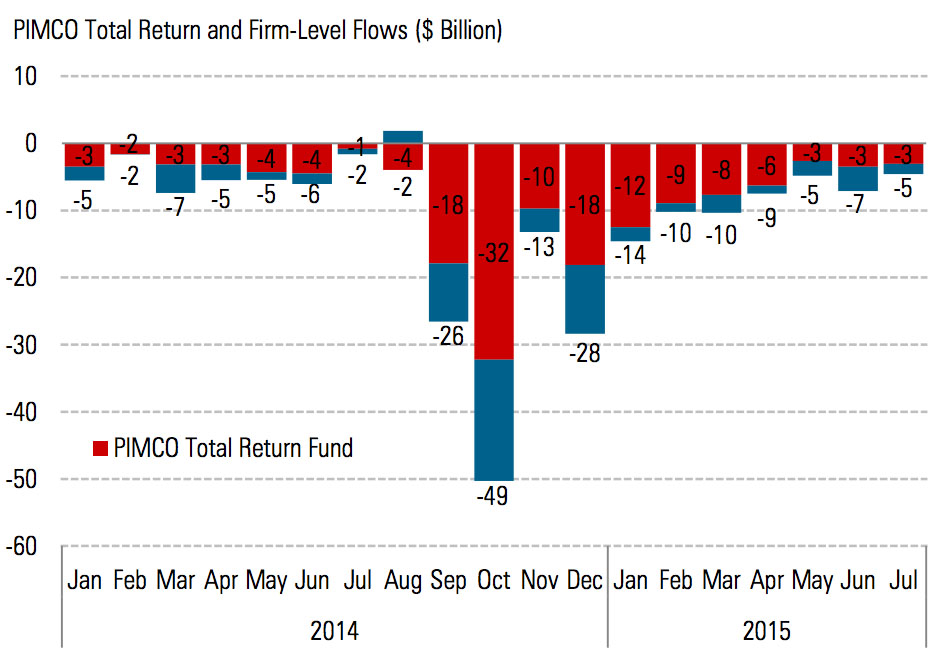

And many investors had chosen to exit. When former CIO Bill Gross announced he was leaving PIMCO for Janus Capital in September 2014, $8 billion flowed out of the Total Return Fund on that day alone. The following month, investors pulled another $27.5 billion, marking a record redemption for the fund. By the end of November 2015, the fund’s assets had trickled down to $163 billion—a drop of $130 billion from its April 2013 peak of $293 billion.

“If you look at their asset levels, it’s actually pretty consistent with what would happen after a big event like this,” said Tim Bruce, director of traditional research at NEPC. “You have this big spike initially where people pull money out and then kind of a trailing down over two quarters of assets, where they stop going out at the same velocity.”

Source: “Morningstar Direct US Asset Flows Update,” August 2015

Source: “Morningstar Direct US Asset Flows Update,” August 2015

In fact, the Total Return Fund—along with bond funds on average—had been losing assets well before Gross’ departure, and posting mediocre returns. In the second quarter of 2013, at the start of the withdrawals, it lost 3.6%, underperforming both Barclays aggregate bond fund and the average fund in its category.

In the aftermath of Gross’ exit, however, the fund has largely outperformed its peers. In 2015 it returned 0.73%, beating 85% of its peers, according to Morningstar data.

“There’s nothing like success in terms of calming people down, and the fund did very well on a relative basis in 2015,” said Jacobson.

The Morningstar analyst attributed PIMCO’s recent success to its ability to manage interest rate sensitivity in year of uncertainty, as well as a low exposure to credit risk. This success, however, is all relative: As Jacobson noted, 73 basis points is still “a very small number.”

“Over the 12-month period, there have been a lot of ups and downs,” he said. “The category was on average down 26 basis points for the year.”

Bryon Willy, a principal at Mercer Investment Consulting, added that factors affecting bond fund performance last year included rate volatility, the commodity sell off, and weakness in emerging markets.

“We’re seeing volatility in a number of areas in the markets where managers finally have the chance to make a decision about whether they want to go long or short something—basically to own something or not,” Willy said. “And it’s making a material difference.”

PIMCO, for the most part, made the right decisions, said Morningstar’s Jacobson.

“The bottom line is, it has tremendous resources there and did well with them,” Jacobson said. “It remains a pretty impressive fund.”

“You never want to give up a huge brain like Bill Gross, but PIMCO has great people there. It has a very good infrastructure.”And as December’s positive asset flows show, investors are taking note. NEPC’s Bruce said that in cases like PIMCO’s, where a big event sparks mass withdrawals, assets usually take the better part of a year to trickle back in—provided, of course, that the fund does well.

“If you think about the big investors, they’re only meeting every quarter,” Bruce said. “It takes three, four quarters for people to get comfortable before they start coming back and reallocating.”

While Jacobson cautioned against ascribing too much importance to the net inflows of a single month, he noted that the flow issue had become less and less acute leading up to December.

“PIMCO had a tremendous bench of talent before Gross left—ironically enough, because he did such a good job of developing it over the years—so the organization was already in pretty good shape,” Jacobson said. “Certainly you never want to give up a huge brain like Bill Gross, but it has great people there. It has a very good infrastructure, and has continued to hire pretty good people. As these things go, PIMCO is doing about as well as you might expect.”

Related: Fade to Black; PIMCO Flagship Suffers Record Outflows Post-Gross; As Investors Yank Capital’s PIMCO’s Total Return Outperforms