The predictions game is a dangerous one, but it’s one many asset management groups find hard to resist.

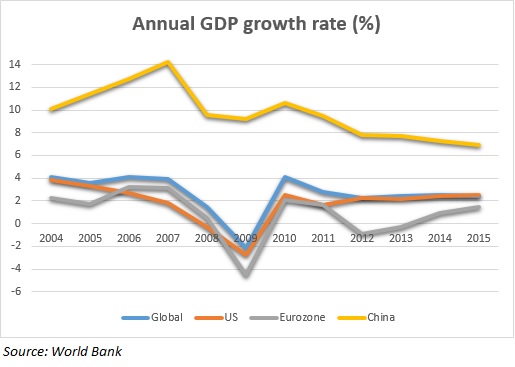

So far this year, China’s slowing economic expansion has come to the forefront again. Markets have not responded well to the US Federal Reserve’s December interest rate hike. Meanwhile, the Eurozone remains problematic despite the introduction of quantitative easing last year, and consumer debt levels across developed markets are as high as ever. Central banks are rapidly running out of ideas to stimulate their economies, with some even employing negative interest rates.

All this has led to a flood of commentaries into CIO’s inbox from asset managers all determined to have their say on a perplexing start to the year.

Is 2016 the year of the next recession?

“Our pessimism on the global economy does not go so far as to anticipate a recession.”“I don’t think so,” wrote Mark Burgess, CIO and global head of equities at Columbia Threadneedle in his latest market commentary. “The first few weeks of this year show us something that we have known all along but perhaps conveniently forgotten: that we are and will remain in a low growth, low inflation and low interest rate environment for some time.”

While admitting that China’s slow transition from industrial expansion to a consumer-led economy has been—and will continue to be—painful for many areas of the world, Burgess argued that a lower oil price would soon feed through to the wallets of developed market consumers.

“With consumption comprising 60% to 70% of Western GDP, this is a real boost to potential economic activity,” Burgess said. “The early signs are that much of this boost is being saved, but at some stage consumers will start to spend their gains.”

Luca Paolini, chief strategist at Pictet Asset Management, said yields on sub-investment grade had risen “to levels more typically seen during recessions.” However, “such a weakening is improbable,” he predicted, “considering the US economy remains on course to expand, fueled by a pick-up in consumer spending.”

Sander Bus, a high-yield bond fund manager at Dutch investment group Robeco, agreed with Paolini’s assessment of his market, but declared that “it is very difficult to predict if there will be a US recession or not, so we’re not going to try to do that.” However, he was not quite able to resist the temptation, adding that “only an ‘armageddon situation’ has not been priced in—but that’s not what we expect.”

“Our US economics team estimates the probability of a US recession at 15% to 20%.”In a recent update from AXA Investment Managers’ research and investment strategy team, the mood was darker. The group cut its forecast (there’s that prediction addiction again) for global economic growth in 2016 from 3.1% to 2.7%. In the US, a “weak external environment” has hit economic activity, the researchers added. They have cut their growth forecast from 2.1% to 1.7% accordingly.

“Our pessimism on the global economy does not go so far as to anticipate a recession,” the researchers stated. “It is fundamentally based on the diagnosis of a global deficit of aggregate demand, not growing fast enough to match global supply, even though the potential growth of the global economy is itself incrementally slowing for lack of investments.”

Goldman Sachs’ commodities research team noted a spike in the price of gold during January, following record inflows for some gold exchange-traded funds. The investment bank’s report was quick to play down the significance of this trade, however.

“Banks have ample liquidity to maintain funding against higher capitalization, the negative macro impacts from low oil prices have likely already played out and are not systemic, while the spillovers from China are limited and the US is far from recession,” it stated.

“Our US

economics team estimates the probability of a US recession at 15% to 20%,” Goldman’s

note continued. Continued strength in the labor market should result in “a

gradual pick up” in wage and price inflation, meaning that “only a large

slowdown” in the employment market would deter the Federal Reserve from its current

path of interest rate rises.

“Our US

economics team estimates the probability of a US recession at 15% to 20%,” Goldman’s

note continued. Continued strength in the labor market should result in “a

gradual pick up” in wage and price inflation, meaning that “only a large

slowdown” in the employment market would deter the Federal Reserve from its current

path of interest rate rises.

Columbia Threadneedle’s Burgess concluded by reminding investors of the “extraordinary” measures employed by central banks to inject some life into various economies following the crisis of 2008 and 2009.

“We are in a low-growth, low-inflation, low-interest-rate world for years to come,” he said.

There is one caveat to this consensus of calls for calm: In-depth research by the Economic Predictions Research Project in the aftermath of the 2008 crisis uncovered just four reputable financial professionals who accurately warned of the impending crash.

None of them were fund managers.

Related: The Psychology of a Selloff & Volatility Is at ‘Normal’ Levels, Says CalSTRS