As ESG standards are formed around the world, the CFA Institute explored the critical elements that make the Middle East unique.

CFA Institute and Principles for Responsible Investment (PRI) interviewed 1,100 financial professionals and conducted 23 workshops in 17 major markets around the world to understand best practices for the integration of Environmental, Social and Governance factors into investment analysis.

While the insights were grouped together for the Europe, Middle East and Africa (EMEA) region, the application of ESG is regionally idiosyncratic. Even the differences between western European countries are stark. What follows are insights as they relate to the Middle East.

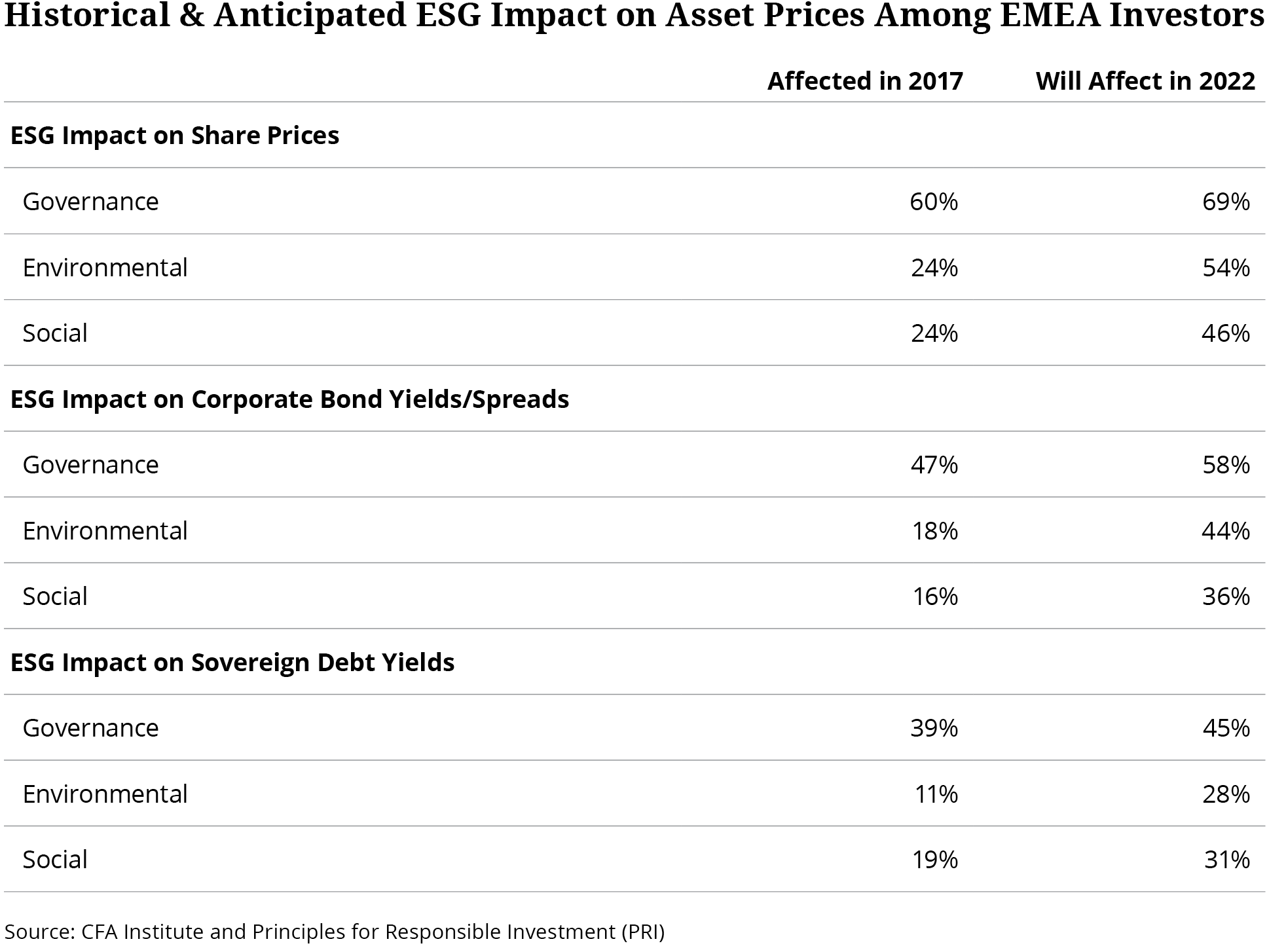

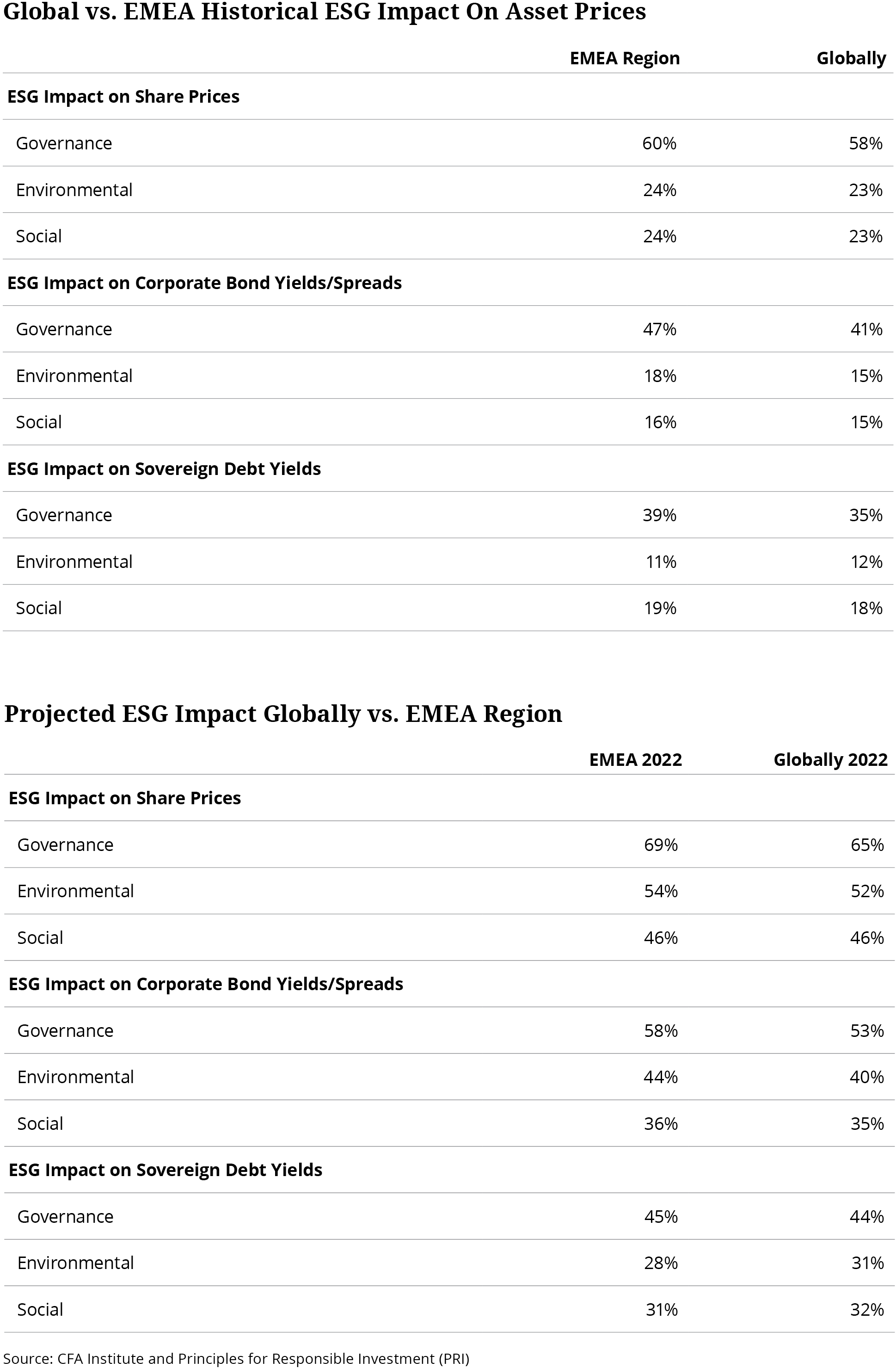

Integration of environmental, social and governance factors into investment analysis is in its infancy in the Middle East. Notwithstanding, the charts below indicate material increases are anticipated in the impact it will have on share prices and bond yields.

The critical element to understand about the integration of ESG in the Middle East is that it is subordinate to Islamic Finance in which in which capital is raised and invested in accordance with shariah law. While this is a complicating factor in many ways, Islamic finance and ESG investing are complimentary, too. Both promote being a good steward to society and to the environment.

Most importantly, ESG investing and Islamic finance both utilize high levels of screening to satisfy their precepts. For instance, Islamic finance prohibits investments in certain industries, such as tobacco, alcohol, pork, pornography, weapons, gambling, human trafficking, and other products and activities that are deemed unlawful (haram).

ESG investment products often contain screening policies that includes one or more of the following criteria:

- Absolute rules, i.e., exclude tobacco, cluster munitions, alcohol, pornography, weapons, gambling.

- Relative rules, e., exclude companies that produce 10% or more of their revenues from tobacco.

- Prohibitive rules, i,e., exclude companies that violate international norms, i.e. UN Guiding Principles on Business and Human Rights, child labor.

- Measurement rules, i.e., companies/issuers with poor ESG rating at large or within each category.

Although they will remain separate investment approaches, Islamic finance and ESG investing are converging. What follows are some of the barriers and drivers to ESG integration in the Middle East.

Demand Driver: International Clients

ESG workshops conducted in the Middle East were comprised of investment professionals working in the Middle East. The participants said that increasing demand from international investors for investment management products that adhere to some form of ESG were a powerful driving force. Not only are international clients asking about ESG, but they are providing guidance as to its application.

As for local investor demand for ESG, participants felt that sovereign wealth funds were less focused on ESG than were life insurance and pension investors. Participants also mentioned that integration of ESG factors was predominantly happening in the equity space. ESG was not talked about much in the fixed-income space, where investors were asking more questions about yields than about sustainability.

Barrier: More Transparency, Better Reporting

Although some companies in the region report on some ESG indicators, ESG reporting remains at an embryonic stage. ESG reporting most often derives from a company’s desire to mitigate the reputational risk associated with poor ESG performance, notably in relation to adverse environmental impact. On the other hand, investors in the region felt governance was the most material pillar in terms of its impact on share prices, corporate bond prices, and sovereign debt prices.

As Arabian Gulf region companies expand their activities and look for capital on the global market, there will be changes. Demands from investors outside the region for ESG data and consideration of environmental, social, and governance issues will likely contribute to both valuation and reputation. Large sectors in the market— infrastructure, energy, real estate, and banking— are well suited to ESG integration.

Regulation: A Barrier And A Driver

Unlike regulators in many parts of the world, those in the Arabian Gulf region are limited in their ability to provide incentives— primarily tax reduction — to encourage the adoption of ESG standards. Despite that restraint, the region seems to require more focus on developing regulations that can be accessed by investors and issuers alike in reducing the costs of complying with regulation.

For instance, the relatively low volume of green sukuk (the Arabic name for financial certificates, also commonly referred to as “sharia compliant” bonds) is attributable to, among other factors, a lack of regulation for investors to adhere to. When coupled with the excess costs of issuance, issuers do not perceive any incentive to float green sukuk other than the reputational benefit.

Driver: Stock Exchanges

Another driving force may come from stock markets in the region that have signed up to become partner exchanges with the Sustainable Stock Exchange (SSE), an UN-sponsored initiative which seeks to align stock exchanges around with world with public policy goals on sustainable development. Regional partners are Dubai Financial Market (DFM) in the United Arab Emirates and the MENA (Middle East North Africa) exchanges consisting of the Bahrain Bourse, the Egyptian Exchange, the Amman Stock Exchange (Jordan), Borsa Kuwait, the Casablanca Exchange (Morocco) and the Qatar Stock Exchange.

The participation of stock exchanges as a catalyst for change cannot be underestimated. The stock exchanges play an important role in driving more and better reporting on the part of the companies listed on them, as they can issue guidance on ESG reporting and organize training and workshops to raise awareness among issuers.

Although they will remain separate investment approaches, Islamic finance and ESG investing are converging. This is not surprising given the origins of each investment approach and their common underlying principles. A deeper understanding of Islamic finance and ESG investing by all investors and the increasing materiality of social and environmental issues will likely continue this trend toward the use of common techniques and analyses.

Case Study: Pan Arab ESG Index

The S&P/Hawkamah ESG Pan Arab Index is emblematic of the fundamental building blocks that are emerging in the Middle East that foster more ESG discussion, and ultimately integration. This index measures the performance of the 50 stocks with the highest score in the Middle East and North Africa on environmental, social, and governance (ESG) factors. The index serves as an investment and benchmarking tool for both purely sustainable investors and for those who want to apply passive strategies with an ESG overlay.

The S&P/Hawkamah ESG Pan Arab Index was the first of its kind in the Pan Arab region. Its ESG methodology is based primarily on quantitative factors, bringing in qualitative analysis as an overlay. The index quantifies ESG factors and translates them into a series of scores measuring securities in the universe of publicly traded Pan Arab companies. It not only ensures a selection of companies with the highest ESG scores, but it is also designed to be efficiently representative of the Pan Arab equity markets by excluding small and illiquid securities. Screened annually, the index uses an innovative ESG score-weighting scheme to ensure that stocks with higher ESG scores have a greater influence on the index than those with lower ESG scores.

The index constituents are selected from a universe of the top 150 Pan Arab companies (based on total market capitalization) listed on the national exchanges of Bahrain, Egypt, Jordan, Lebanon, Kuwait, Morocco, Oman, Qatar, Saudi Arabia, Tunisia, and the United Arab Emirates, subject to a liquidity screen.The index comprises the 50 highest-scoring stocks, according to their composite ESG scores from the selection universe, subject to a maximum individual country representation of 15 stocks. As a first step, the scoring process assesses companies’ levels of ESG transparency and disclosure on 197 indicators, including carbon emissions, water and energy consumption, employee health and safety, community investment, charitable giving, financial reporting, auditing, board independence, and executive remuneration. The scoring process includes looking at each company’s actual sustainability performance characteristics, based on independent sources of information, news stories, websites, and Corporate Social Responsibility (CSR) reports.

Case Study: SEDCO Capital

SEDCO Capital, headquartered in Jedda Saudi Arabia, has pioneered a Prudent Ethical Approach that combines sharia compliance with ESG investing. SEDCO has deep roots in the Middle East, and as such, offered investors access to investment opportunities they were unlikely to access elsewhere. With its Prudent Ethical Approach, SEDCO stands at the forefront of ESG investing in general and in the Middle East in particular.

The common denominators between the two principles is the exclusion of so-called ‘sin sectors’ such as alcohol, tobacco, and gambling. Further, sharia compliance requires screening of balance sheet ratios such as leverage, cash and interest-bearing securities, and/or accounts receivable to market cap or total assets, whichever is greater. And the “Ethical” aspect of SEDCO’s investment style integrates an assessment of environmental, social, and corporate governance criteria.

Historically, the exclusion of sin stocks has led to a deterioration of investment performance. SEDCO’s performance shows, however that the balance sheet constraints of Islamic investors can improve risk-adjusted returns of conventional and responsible investment portfolios.

For SEDCO Capital, being a prudent investor means avoiding undue risks and seeking sustainable investments with strong governance that comply with relevant regulation. SEDCO Capital has found an ESG overlay can lead to long-term rewards in terms of risk reduction and potentially higher returns.

The key building blocks in the responsible investment process for SEDCO Capital’s listed equities business work at five distinct levels: (1) negative screening, (2) environmental factors, (3) social factors, (4) governance factors, and (5) active ownership through proxy voting.

Matt Orsagh, CFA, CIPM, is a director of capital markets policy at CFA Institute, where he focuses on corporate governance issues. He was named one of the 2008 “Rising Stars of Corporate Governance” by the Millstein Center for Corporate Governance and Performance at the Yale School of Management.

Tags: CFA Institute, ESG, Middle East