Investors with the best intentions of diversifying the risks in their portfolio may well be paying “astonishingly high fees” and negating any potential upside, two researchers have claimed.

In a paper named “Fees Eat Diversification’s Lunch”, William W. Jennings and Brian C. Payne from the US Air Force Academy, Colorado, set out the findings of their investigation. The authors highlighted how much investors—from the smallest to the largest—are paying and the effects it has on their portfolios.

(Source: Jennings & Payne)“By comparing the incremental benefit of diversification

with the incremental cost, we show many seemingly attractive investments become

unacceptable as diversifiers,” the authors wrote. “We also show that fees

re-arrange the relative attractiveness of many diversifying asset classes.”

(Source: Jennings & Payne)“By comparing the incremental benefit of diversification

with the incremental cost, we show many seemingly attractive investments become

unacceptable as diversifiers,” the authors wrote. “We also show that fees

re-arrange the relative attractiveness of many diversifying asset classes.”

Using data from JP Morgan’s Long-Term Capital Markets Return report and actual fees reported by institutional investor clients with assets worth more than $2 trillion, the authors plotted how much of the diversification benefit they were paying away.

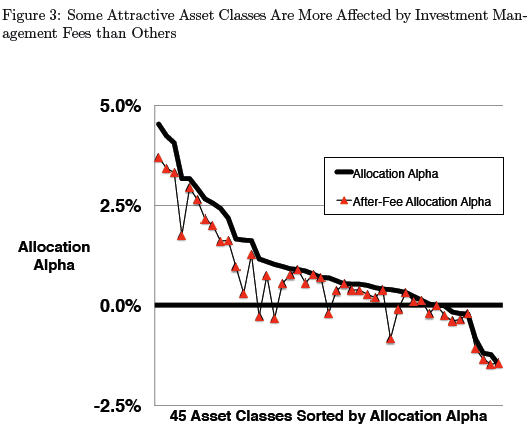

A set of 45 asset classes were examined, considering the alpha each generated and the amount of this excess return that was “eaten” by fees. They found each investment was hit very differently (figure 1).

“Using a one-half alpha threshold as an acceptable fee limit, fully 40% of the asset classes are eliminated from consideration as diversifiers—half of these due strictly to investment management fees,” the paper said.

“We think that readers will be surprised by… how much of the diversification benefit is absorbed by higher fees.” —Jennings & PayneThe researchers also split up the data and created model investors: small endowment, state pension, quality foundation. Unsurprisingly, they generally found the smaller the investor, the greater the likelihood its fees were higher.

However, they also found that price bartering benefits available to the largest investors were mainly beneficial for core asset classes, such as bonds and large cap US stocks.

“Thus the incremental cost for the quality foundation is sometimes higher than for the state pension and small endowment getting median fees,” the pair reported. “This is not the result we anticipated when we generated our three fee scenarios.”

Additionally, the paper stated that investment consultants were often not helpful in advising clients on the matter of diversification.

“Many investment consultants prefer to separate asset allocation decisions from manager selection and investment vehicle discussions. Our analysis demonstrates that doing so is unwise,” the pair said. “Fees are central to investment vehicle and manager evaluation.”

In conclusion, the authors urged investors to consider who is actually taking the risk: them as asset owners with fiduciary responsibility to others, or the managers who can just walk away?

“While it might seem obvious that diversifying asset classes have higher investment management fees, we think that readers will be surprised by the magnitude of the problem—of how much of the diversification benefit is absorbed by higher fees,” the authors said.

The full paper is available to download.

Related Content: How Did Balanced Funds Weather the Crisis? & How to Capture Alpha through Beta