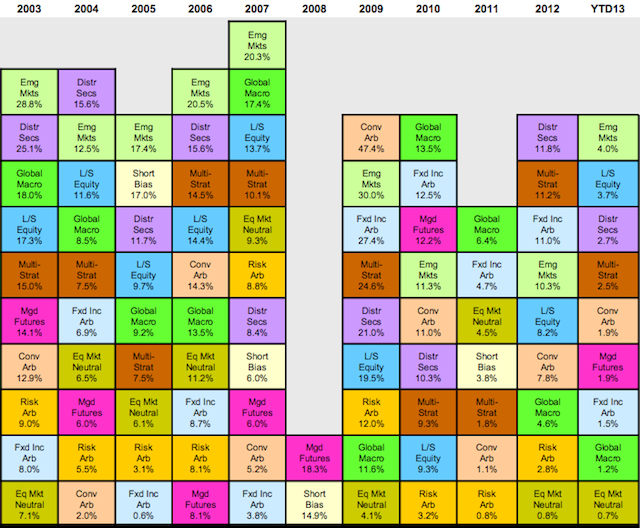

(March 21, 2013) - Emerging markets are the hydrogen of the hedge fund universe.

That is, managers focused on the frontier have earned the number one spot for 2013 (year-to-date) on Boomerang Capital's latest Periodic Table of Hedge Fund Returns. In the 12 years that Boomerang, a Connecticut-based advisory firm, has covered in their tables, emerging markets have taken the Hydrogen Prize (our term, don't blame them) a record four times. If the strategy finishes 2013 as strong as it started, emerging market managers are in for at fifth win.

This is just the latest notch in emerging market managers' increasingly carved-up bedposts. Institutional investors at the recent Commonfund Forum voted emerging market equities the most promising place to invest, with 78% expecting the MSCI Emerging Markets index to outperform the S&P 500 over the next three years.

Likewise, aiCIO has been interviewing top young asset owners for its annual Forty Under Forty list, and having each predict the best-performing asset class for the next five years. You can probably guess the answer we've been hearing again and again.

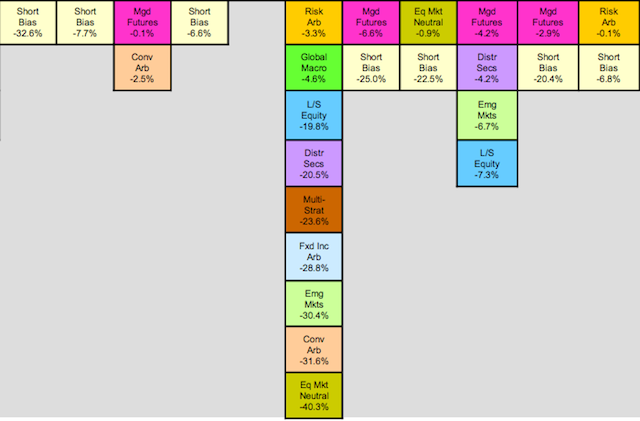

Short bias-focused funds are in the lead to become 2013's Ununoctium-the terrific name is a consolation prize for posting the worst annual returns of any hedge fund strategy. It's been a rough couple of years for short-inclined managers. The HFRI short-bias index lost 17.24% in 2012--far more than the next-weakest performer, energy and basic materials (-5.69%).

Still, the strategy of shorting equity markets has proven successful at two things. Number one: Winning the Ununoctium Prize. A triumph in 2013 would bring the total up to six, far more than any other strategy. Number Two: Hedging equity markets. Short-bias managers were probably happy to trade in the prize in 2008 for 14.9% average returns.

All this being said, 2013 still has plenty of time for surprises.

Boomerang's table is based on data from Dow Jones Credit Suisse hedge fund indices as of March 15, and ranks the strategies based on total returns. Check out Boomerang Capital's archived tables here.