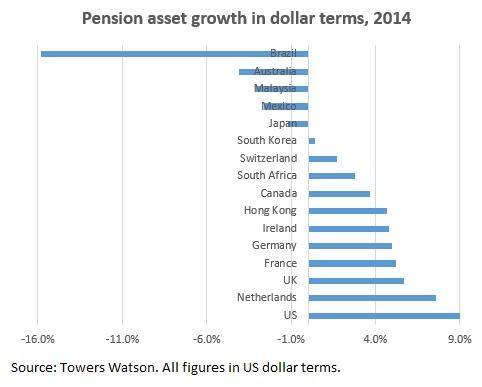

Pension funds around the world saw asset growth stall in 2014, according to a global survey from consultancy Towers Watson.

Measured in dollar terms, the average growth of pension assets in the 16 countries surveyed by Towers Watson was 1.5%, compared with 8.3% in 2013.

Global pension assets grew 6.1% in 2014, totalling $36.1 trillion, of which 61% were US pension fund assets.

The decline in the average asset growth rates is in part

explained through currency movements, Towers Watson said. In 2014 all currencies

relevant to the survey depreciated against the dollar: in dollar terms, Japan’s

total assets declined 1.2%, but in local currency terms assets rose by 12.7%.

The euro also depreciated against the dollar by more than 10%.

The decline in the average asset growth rates is in part

explained through currency movements, Towers Watson said. In 2014 all currencies

relevant to the survey depreciated against the dollar: in dollar terms, Japan’s

total assets declined 1.2%, but in local currency terms assets rose by 12.7%.

The euro also depreciated against the dollar by more than 10%.

Combined assets were equal to 84.4% of the combined GDP of these countries. In some of the biggest markets—the US, the UK, Australia, the Netherlands, and Switzerland—pension assets comfortably exceeded GDP.

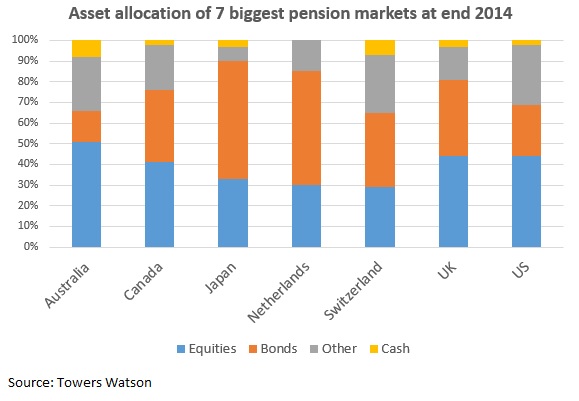

In the seven largest pension markets (Australia, Canada, Japan, the Netherlands, Switzerland, the UK, and the US) average allocation to bonds increased, while the amount held in cash and alternatives fell. Equity allocation remained static. However, since 1995 alternatives (including property) have increased from an average 5% of assets to 25% at the end of 2014.

Within the equity exposure, most pension funds are relying less on domestic equity exposure, Towers Watson found. In six of the seven biggest markets—with the exception of the US—domestic equity exposure was below 50% of total equity holdings at the end of 2014, and had been declining steadily for several years.