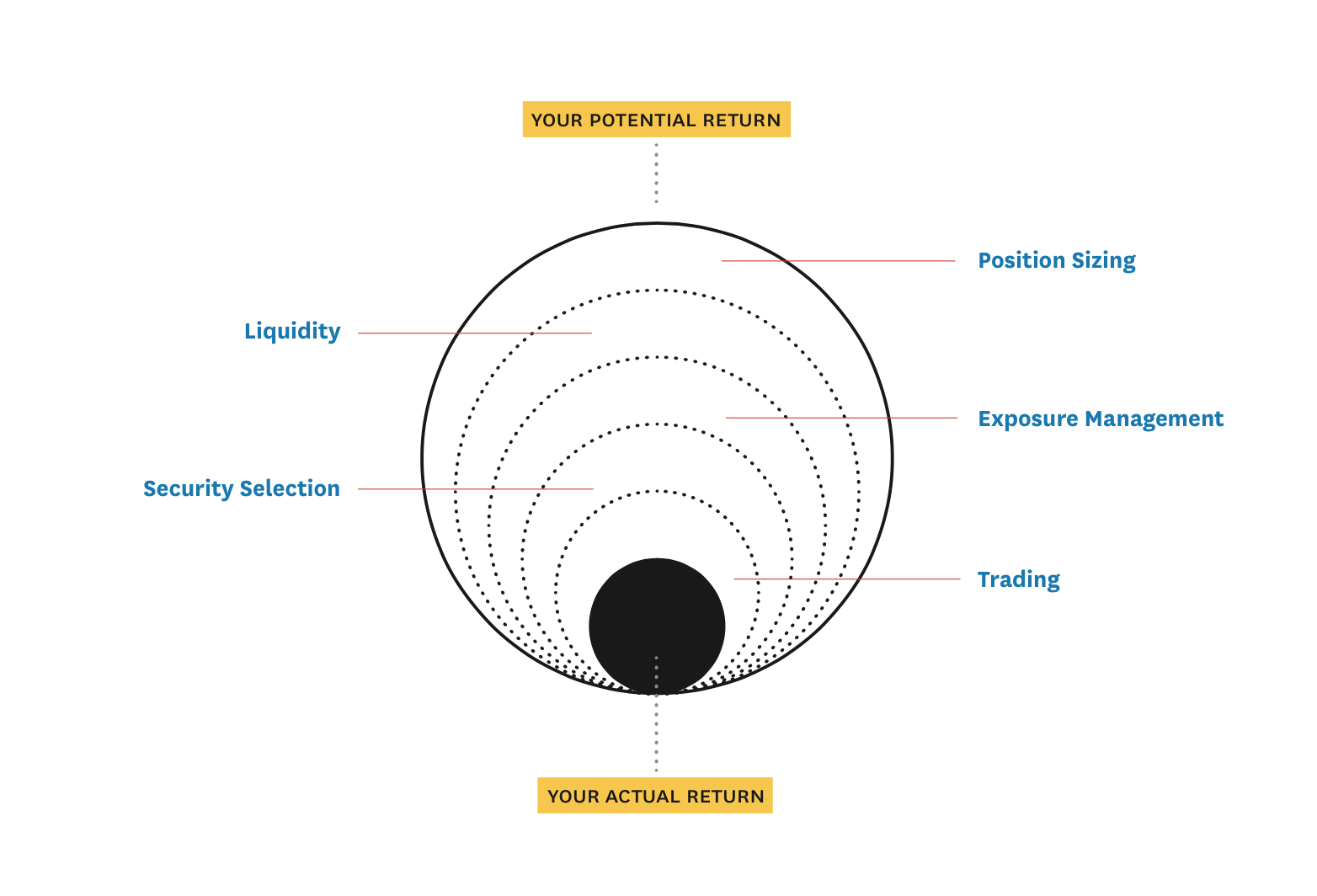

Hedge fund managers often fall victim to behaviors that cost them major returns or leave them in mediocrity, according to analytics firm Novus.

While successful managers are able to show conviction, portfolio management, and excellent risk control, those that report lackluster performance displayed various “alpha-robbing” behaviors, the report said.

Most commonly, managers could lose a lot of alpha by incorrectly sizing their positions.

“The mistake we see managers make is consistently losing money on their smallest positions,” the report said. “Some managers call them ‘farm’ positions and don’t have enough conviction in them to size them up in the portfolio.”

However, keeping these small positions could be a big “drag on performance,” Novus claimed. Instead, managers should either exit these holdings or increase their size to gain positive returns.

Certain managers were also guilty of failing to properly time the market, the report found.

Only a few star managers were able to time the market well year after year, Novus said, and many were excessively reactive to market directionality. They aim to time the volatility and end up straying from their core competency.

“Most fundamental managers would be significantly better off keeping a static net exposure to the market instead of moving it around opportunistically,” the report said.

Managers should also stick to their knitting in selecting securities, according to the report, to avoid losing valuable alpha. Investing in a sector where a manager has shown consistent poor skill—low win/loss ratio and batting average—could easily backfire.

Managers could see value diminished in their portfolios by overtrading, particularly on the short side, Novus said. And many should reevaluate their illiquid allocations to ensure they do not become the worst performers in the portfolio.

However, most managers may not even be aware of how much alpha they are losing from these bad behaviors, the report said. Studying the “historical analysis of past trades” could help managers identify certain mistakes to gain and retain alpha.

Source: Novus

Source: Novus

Related Content: Top Managers Monopolizing HF Assets, Preqin Finds; Don’t Blame the Hedge Fund Managers