US-based foundations are investing a surprisingly small amount of capital to real estate, according to Preqin.

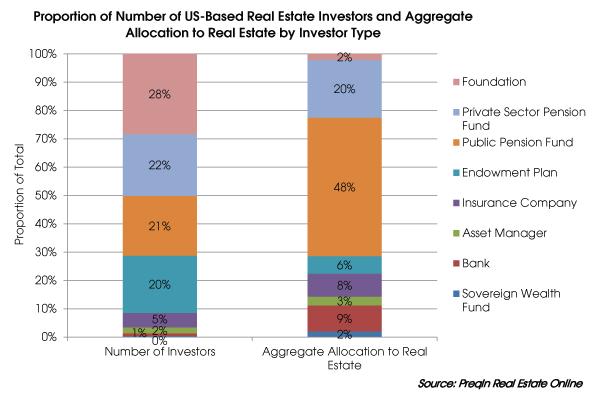

The firm’s data showed foundations made up 28% of US-based real estate investors, but represented just 2% of total invested assets.

More than two-thirds of foundations allocated less than 5% of their total assets to real estate, Preqin said. Some 28% invested between 5% and 9.9%, while just 8% allocated more than 10% to the asset class.

Endowments exhibited similar figures, Preqin found. While they made up one-fifth of total real estate investors, they accounted for only 6% of total allocated capital.

These

disproportionate allocations paled in comparison to pension and sovereign

wealth funds.

These

disproportionate allocations paled in comparison to pension and sovereign

wealth funds.

According to Preqin, only 21% of real estate investors were public pension funds but they represented nearly half of aggregate allocation to the asset class.

Just seven sovereign wealth funds also collectively made up the same proportion of capital invested in real estate as foundations.

In a previous report, Preqin found some 77% of sovereign funds currently allocate up to 9.9% in real estate and 93% have a target allocation of between 5% and 14.9%.

“Foundations’ relatively small real estate allocation reflects the investor type’s typically small assets under management,” the report said.

Nearly 45% of foundations in Preqin’s dataset had less than $250 million, 80% had less than $1 billion, and only 5% managed $5 billion or more.

Foundations invested in real estate were also concentrated in California, New York, Illinois, Massachusetts, and Pennsylvania, the report said.

Related: Bespoke Deals on the Rise in Real Estate & Sovereign Wealth Funds’ Real Estate Rush