The final quarter of 2014 is to see a major pick up in private equity activity, according to Preqin, with major fundraising already underway and record levels of dry powder.

An aggregate $73 billion was raised by private equity funds that closed in the third quarter, Preqin said. This was the lowest quarterly total in three years.

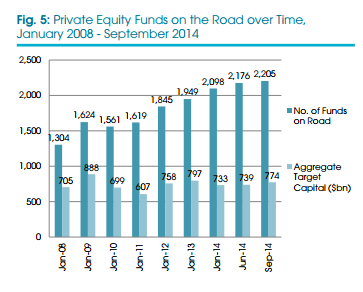

But

a record 2,205 funds are currently seeking capital from investors, with an

aggregate target of $774 billion, which Preqin said pointed to increased levels

of activity in the fourth quarter and into 2015. These figures include buyout

funds from Blackstone, TPG Partners, and Hellman & Friedman, all of which

are seeking more than $8 billion each.

Christopher Elvin, head of private equity products at Preqin, said: “This quarter’s private equity fundraising fell short of the $100 billion mark for the first time in over a year, with the lack of mega buyout funds closing undoubtedly a factor that contributed to these lower fundraising figures.

“However, the third quarter of the year is typically a quieter one for the industry, and with several mega funds currently in market, fundraising is likely to pick up again towards the end of the year.”

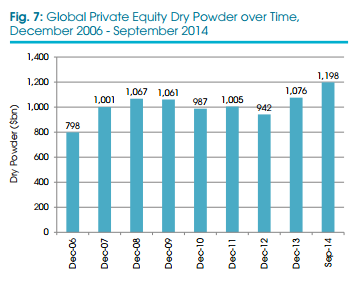

Private equity funds are also sitting on $1.2 trillion of cash yet to be deployed, an all-time high. For buyout funds alone, Preqin said the level of dry powder was $464 billion, the highest since December 2009.

Separate

research by Preqin revealed that closed-end private real estate funds also have

record levels of uninvested capital, with $220 billion of dry powder.

Despite the low levels of activity in Q3, August saw both the largest private equity-backed buyout investment and the largest exit if the year. 3G Capital’s investment in Canadian coffee chain Tim Hortons was valued at $11.5 billion, while a group of investors including the Canada Pension Plan Investment Board exited their investment in UK pharmaceutical outlet Alliance Boots for $15 billion.

Related Content: Private Equity Distributions Hit Record High in 2013 & Deals Collapsing Over Fee Disagreements