Japan’s $1.25 trillion Government Pension Investment Fund (GPIF) has taken a step towards riskier investments with the hire of a private equity specialist to sit on its investment committee.

The GPIF has appointed Hiromichi Mizuno to the committee, currently a partner at private equity group Coller Capital, according to Reuters. He will continue to hold his role at Coller.

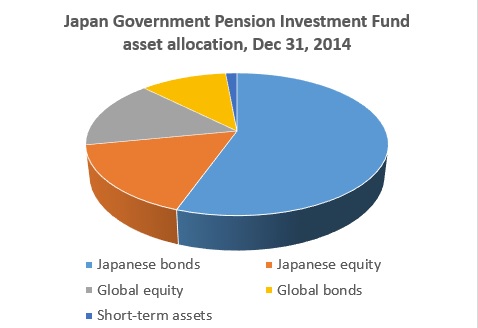

The pension’s investment committee consists predominantly of economists and academics, but the appointment of Mizuno is a sign that the GPIF is beginning to act on its plans to diversify out of government bonds, which are one of the lowest-yielding fixed income securities in the world.

Mizuno replaces Kimikazu Nomi on the investment committee, who is CEO of state-backed investment group Innovation Network Corporation of Japan.

As well as the intention to move into private equity, the GPIF has also signalled its intention to buy into infrastructure and inflation-linked bonds.

The fund is under pressure to improve its performance due to the ageing Japanese population: Since 2009-10 it has been paying out more to Japan’s pensioners than it has been receiving in contributions from workers. In 2013 the fund registered an 8.6% return.

Related content: Government Advisor Urges GPIF to Sell $245B of Japanese Bonds & Japan Pension Ponders Nikkei-Boosting Game-Changer