(April 10, 2013) - Charles Skorina has another ranking out, and this time it is public endowments in the spotlight.

The dozen public US universities included in the following lists comprise what Skorina—the prolific ranker and founder of an eponymous executive search and research firm—terms the "Public Ivys." He based his list off of a 2001 ranking by education consultants Howard and Matthew Greene.

As Skorina points out, "public" does not mean poor: these 12 endowments range in size from the $18 billion University of Texas' pot to the University of Minnesota's $1.5 billion. The University of Texas Investment Management Company (UTIMCO) controls more money than Princeton. Michigan's endowment is bigger than Columbia's or the University of Pennsylvania's, and the University of California Regents have more assets under management than Duke or Cornell.

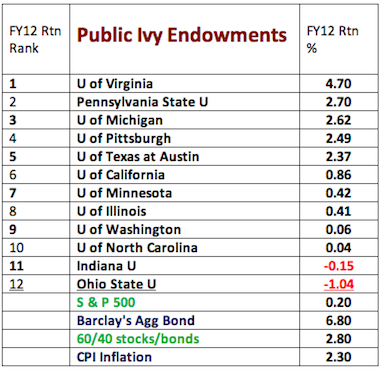

The University of Virginia Investment Management Company (UVIMCO), which runs $5.43 billion for the institution, comes out on top of every one of Skorina's rankings, except size. CIO Lawrence Kochard and his predecessor Christopher Brightman posted the best five-year returns of the group—by far—with gains of 4.7% at the close of fiscal year 2012.

Kochard again triumphed with one-year returns of 5.1%, topping the second-place University of Pennsylvania's 3.5% gains. Skorina also ranked the group's performance by Sharpe ratio, and UVIMCO again takes the number one spot, far outpacing the number two endowment, UTIMCO.

And Kochard is handsomely rewarded for his performance. According to Skorina, his most recently available annual compensation was $3.56 million. (The University of Virginia disputes this figure: a spokesperson told aiCIO Kochard's income is $1.38 million.) By Skorina's measure, the Virginia endowment chief edged out his counterpart in Texas, Bruce Zimmerman, who earned $3.24 million in salary and bonuses. Skorina gathered this data from public filings and financial statements. Most of the compensation figures are for the 2010 calendar year.

Further Rankings:Top-Performing Pensions, Endowments and Foundations

Related blog post: Are Returns-Based Rankings Meaningless?

Update: Two of the CIOs listed have disputed Skorina’s compensation figures. aiCIO contacted Skorina, who said the figures are based on published data provided by endowments to the Internal Revenue Service in 9-90 forms, as well as financial statements from annual reports, and occasionally college newspaper reports. He said he includes all forms of compensation (including deferred) for which data is available. “Pensions are income, so are health benefits,” Skorina said. “Perception is a major factor here. People think income is what they take home, but that’s only part of it.”

Five-Year Returns (FY 2008 - 2012)

Five-Year Risk-Adjusted Returns (FY 2008 - 2012)