(May 12, 2014) — The trend away from equity investments in real estate could hit a milestone this year, as debt becomes a favoured option for many, data has shown.

In 2013, for the first time in more than five years, closed-end funds offering solely equity options for real estate investors accounted for less than half of the capital committed to the sector, data monitor Preqin has found.

Just 49% of the billions of dollars earmarked for the sector went into equity-exclusive funds in 2013, down from 69% in 2009. The majority of assets headed for funds offering just debt, or a combination of the two options, for the first time in five years. This trend towards debt, or combined debt and equity funds, has been maintained over the last five years, despite a blip in 2012.

“Aggregate capital raised by primarily debt-focused funds [decreased] from a significant $13 billion for funds closed in 2011 to $5.6 billion in 2012,” said Preqin. “However, 2013 saw capital raised for this strategy more than double to $12.2 billion and 2014 so far has already raised more than this, with $13.2 billion raised from 10 funds. As such, fundraising for debt-focused funds appears to be gaining momentum as investor confidence in the strategy increases leading to greater amounts of capital flowing into such funds.”

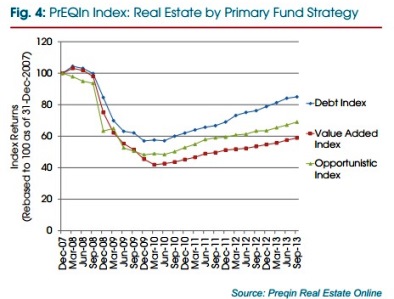

One of the reasons behind this change has been the better returns being made from debt investments. Since December 2007, Preqin’s Real Estate Debt Index has outperformed both the Value Added and Opportunistic indices. The returns, rebased to 100%, are shown on the chart below.

Asset managers and other providers have realised the move too. The number of options being offering to investors this month—some 53 primarily debt-focused funds—has doubled from 26 in 2010. They are also targeting more than double the assets: $22 billion, up from $10 billion.

“This increase demonstrates that fund managers were quick to capitalize on the large opportunity to invest in real estate debt resulting from the retreat of traditional market lenders,” Preqin’s report said.

However, investors should be aware and carry out thorough due diligence on their potential new partner, the data monitor warned: “The relatively recent emergence of debt as a strategy for private real estate funds also means that a large proportion of managers raising debt funds have limited experience regarding the strategy, despite many having long track records in the private equity real estate space. Seventy percent of capital targeted by debt funds in market is by managers raising their first debt fund.”

Related content: The Hassle—and High Potential—of Direct Real Estate & Small Private Real Estate Funds Squeezed Out by Larger Rivals