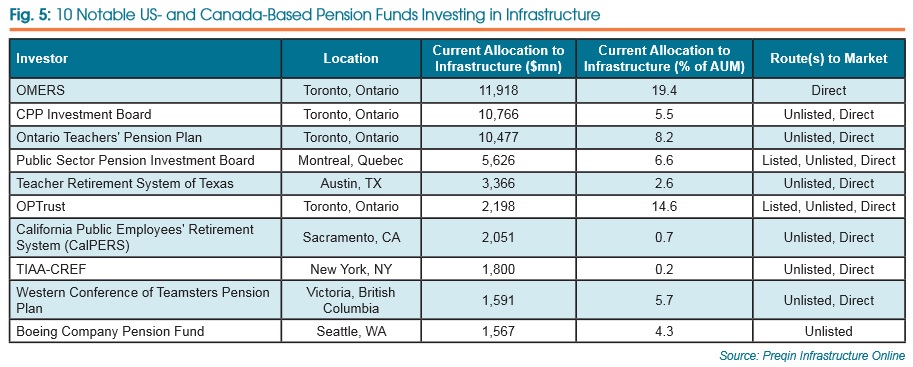

Canadian pension funds have a stronger appetite for infrastructure investments than their US peers, with nearly six times more capital allocated, according to Preqin.

Nearly 70 private and public plans in the Great White North—with an average of $14.6 billion in assets under management—reported a current average allocation of 5.3%, or $1.08 billion, of total assets to infrastructure. Some 61% said they invested at least 5% of their total assets.

This figure was slightly lower than the average target allocation of 8.4%, or $1.17 billion.

US funds, on the other hand, only had an average exposure of 2% to infrastructure, leaving room to meet the target allocation of 4%. The current average allocation was just $172 million from an average of $17.6 billion of total assets. The vast majority—80%—of US funds allocated less than 5% of their portfolio to infrastructure.

While an overwhelming majority—97% of Canadian and 93% of US funds—chose unlisted funds, there was a significant portion (35%) of Canadian plans directly investing in infrastructure. Only 1% of US funds directly invested, Preqin found.

The way infrastructure allocations were reported was also markedly different north of the border: Three-quarters of Canadian plans had separate infrastructure allocations, while US funds largely preferred to invest through broader private equity and real assets allocations.

The California Public Employees’ Retirement System this week made its first

venture into Asia-Pacific infrastructure, with Australian manager QIC running an A$1

billion (US$764 million) mandate.

This deal will push the pension fund’s total real assets allocation beyond $30 billion, or nearly 10% of total assets.

Meanwhile, the C$215 billion ($179.5 billion) La Caisse de dépôt et placement du Québec also inked a deal with the province’s government this year to fund “major infrastructure projects” upwards of $4 billion.

The agreement “will allow us to increase our exposure to infrastructure while concretely putting our expertise to work for Quebec’s economy,” Michael Sabia, president and CEO of a Caisse, said in January. “These investments will generate returns that help to secure Quebecers’ retirement for the future. It’s a win-win partnership that benefits everyone.”

Related Content: CalPERS, QIC Force A$1B Infra Partnership; Canadian Pension Pens $4B Infrastructure Deal; Why the Heathrow Express is Insanely Expensive