Fund managers are stockpiling cash to a degree not seen since the collapse of Lehman Brothers, according to a survey by Bank of America Merrill Lynch (BoAML).

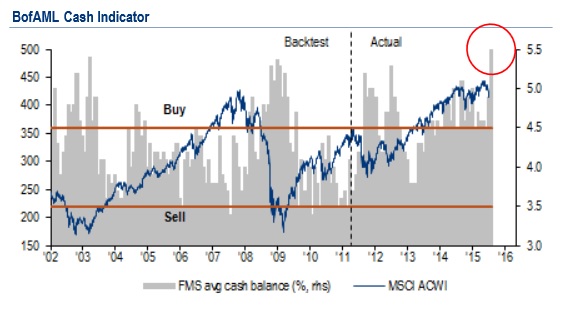

The bank quizzed 191 managers responsible for more than $500 billion cumulatively and found that average cash levels had risen to 5.5%, the highest figure recorded by BoAML’s monthly survey since December 2008.

“Rising risk aversion and stretched cash levels provide a contrarian buy signal for risk assets in Q3.” —Michael Hartnett, BoAMLAlmost 25% of investors said they had taken out some form of protection against equity market falls—the greatest portion to do so since February 2008.

Cash levels in BoAML’s survey last spiked to 5% in December 2014, when oil prices had collapsed. At that time, an increasing number of managers were shifting into Eurozone equities—this month, this region was, unsurprisingly, out of favour.

However, BoAML also found few indicators of “macro capitulation”: expectations of company profits and inflation stayed stable, and investors had generally remained “stubbornly long” in stocks and cash.

“Rising risk aversion and stretched cash levels provide a contrarian buy signal for risk assets in Q3,” argued Michael Hartnett, chief investment strategist at BoAML Global Research.

Source: Bank of America Merrill Lynch Fund Manager Survey. Cash above 4.5% is ‘buy’ signal; below 3.5% is ‘sell’ signalThe biggest tail risk was deemed to be a breakdown of the

Eurozone, with 26% of managers citing it as their greatest concern—although the

survey was conducted before the agreement struck by European policymakers over

the weekend on Greece’s debt repayments.

Source: Bank of America Merrill Lynch Fund Manager Survey. Cash above 4.5% is ‘buy’ signal; below 3.5% is ‘sell’ signalThe biggest tail risk was deemed to be a breakdown of the

Eurozone, with 26% of managers citing it as their greatest concern—although the

survey was conducted before the agreement struck by European policymakers over

the weekend on Greece’s debt repayments.

Manish Kabra, European equity strategist, said despite the uncertainty created by the ongoing discussions, “intention to own European assets is high and rising, though global growth remains vitally important for European stocks.”

Chinese debt defaults were also cited as a major risk to investor confidence, with 21% of managers saying it was their top concern. This compared to 12% from the June survey.

Managers have also shifted their expectations for the next Federal Reserve interest rate increase. Last month the majority (roughly 54%) expected a rate hike in the third quarter of this year, but this fell to less than 40% in July. Roughly 45% of managers said they expected the Fed to delay its first rate rise until the fourth quarter.

Related: Managers Hoarding Cash as Oil Plummets & Why Cautious Managers Have Short Careers