Sovereign wealth funds (SWFs) have become more free-thinking and contrarian following the financial crisis, according to analysis by State Street Global Advisors (SSgA).

Portfolio data collated from 2002 to 2014 indicated that sovereign funds invested similarly to one another in the years leading up to the banking crisis, but began to diverge after 2007. Divergence has accelerated since 2012, SSgA’s analysis showed.

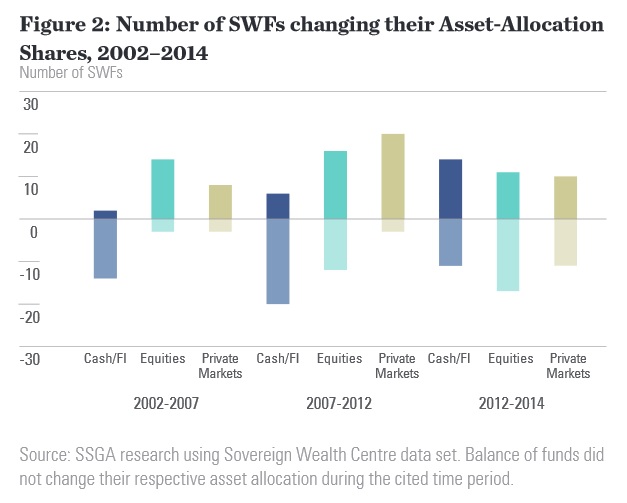

Between 2002 and 2007, funds tended to move out of fixed income and into equities, as stock markets around the world rose. After

the 2008-09 banking crisis this trend weakened—although appetite for unlisted

assets grew rapidly—and by 2014 the number of SWFs buying or selling equities

or bonds was broadly balanced.

Between 2002 and 2007, funds tended to move out of fixed income and into equities, as stock markets around the world rose. After

the 2008-09 banking crisis this trend weakened—although appetite for unlisted

assets grew rapidly—and by 2014 the number of SWFs buying or selling equities

or bonds was broadly balanced.

“While they each have their particular reasons,” wrote Elliot Hentov, head of policy & research at SSgA’s official institutions group, “it does suggest an increasing divergence of views about market opportunities and portfolio management.”

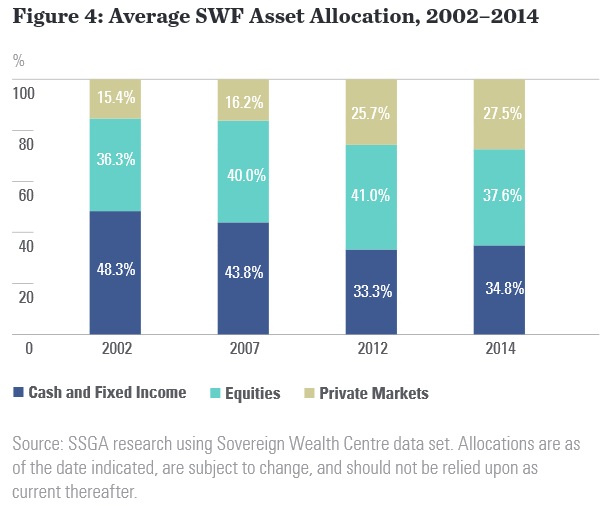

SWFs’ asset allocation has also differed dramatically from the overall trends in asset management globally in recent years, Hentov found. Focusing on the period 2012 to 2014, he found a strong trend globally out of fixed income and into equities—but SWFs on average sold down equities in favor of fixed income and private markets.

“While we could point to only one recent time period, the opposite trends among SWFs and the larger asset management industry are remarkable,” Hentov said. “We can only speculate on the reasons for this divergence, but long-term thinking and fewer tangible liabilities presumably allow SWFs to detach investment decisions from short-term market cycles.”

In his analysis, Hentov also observed a divergence in approach between the largest funds and the smaller, newer SWFs.

The largest commodity-driven funds, such as those from Norway and the Middle East funded by oil sales, were shown to have rebalanced out of fixed income in favor of equities between 2002 and 2007, while smaller funds did not make a similar move until much later.

Overall, between 2002 and 2014 SWFs’ average asset allocation evolved from being reliant on fixed income to a much greater focus on private market assets. The data “suggest funds have stabilized near a 40-40-20 asset allocation to cash and fixed income, equities, and private markets respectively,” Hentov said.

Read Hentov’s paper, “How

do Sovereign Wealth Funds Invest? A Glance at SWF Asset Allocation”.

Read Hentov’s paper, “How

do Sovereign Wealth Funds Invest? A Glance at SWF Asset Allocation”.

Related: Is ADIA a Threat to Asset Management? & Old School Asset Managers, Meet New SWFs