More than a fifth of institutional investors plan to allocate more than $1 billion of fresh capital to private equity in 2016, despite fears that the sector is reaching peak valuation.

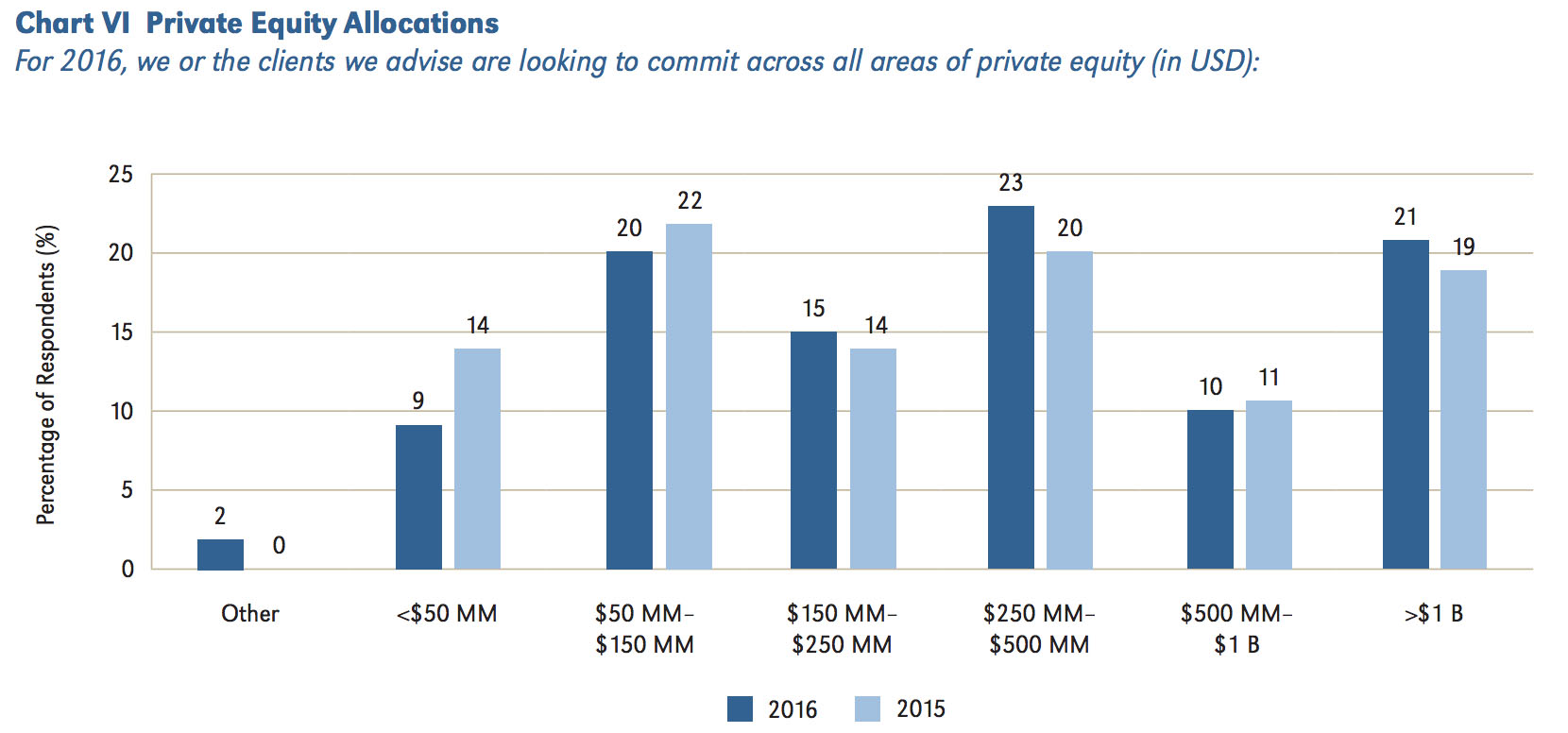

A survey by Probitas Partners found that 21% of investors planned to commit more than $1 billion, while just 9% targeted an allocation less than $50 million.

No respondents planned to reduce their private equity target, while 17% said they are considering an increase.

This is despite nearly half of the respondents believing private equity to be at the top of its cycle—meaning a decline is looming. Of investors surveyed, 51% said too much money is pursuing too few attractive opportunities across the sector. More than a third said price multiples in middle-market ($500 million to $2.5 billion) and large-market ($2.5 billion to $5 billion) buyouts are too high, threatening future returns.

Data firm Preqin has estimated that private equity firms worldwide held $1.32 trillion in unspent capital at the end of September 2015.

Another issue raised by Probitas’ survey was management fee levels, which 28% of investors said were destroying alignment of interest between fund managers and investors.

In spite of these concerns, 61% said they were considering expanding their current general partner relationships, while 27% said they were actively pursuing relationships with new managers. Just 6% said they were looking to decrease the number of relationships significantly.

Investors were most interested in US middle-market buyouts, a sector targeted by 76% of survey respondents. Other types of buyouts—including European buyouts and US buyouts of other sizes—were also popular, through interest dropped for buyouts larger than $5 billion.

Investors also favored growth capital funds in developed markets (preferred by 42%) and distressed debt funds (targeted by 31%).

Least popular were agriculture funds, timber funds, and green-focused funds.

Source: Probitas Partners’ “Private Equity Institutional Investor Trends for 2016 Survey“

Source: Probitas Partners’ “Private Equity Institutional Investor Trends for 2016 Survey“

Related: The Best and Worst Asset Classes of 2016; The Argument for Private Equity; Crowded: Is PE in the Bubble of All Bubbles?