Institutional investors are increasingly turning to factor investing—and hedge funds are by far the most preferred route, according to Citigroup.

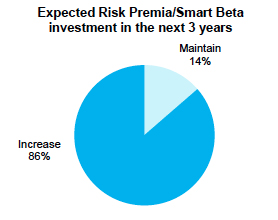

In a survey of investors representing close to $1 trillion in total assets, the bank found that 81% were either currently investing in or looking to invest in smart beta and risk premia strategies—with 86% planning to increase factor investments over the next three years.

Hedge funds were the most preferred vehicle for factor investing, chosen by 69% of respondents.

Source: Citi Prime Finance Survey“As interest in risk premia solutions continues to rise, we expect hedge funds to play an increasingly important role in providing diversification through risk-aligned strategies,” said Daniel Caplan, Citi’s head of investor services sales for Europe, the Middle East, and Asia.

Source: Citi Prime Finance Survey“As interest in risk premia solutions continues to rise, we expect hedge funds to play an increasingly important role in providing diversification through risk-aligned strategies,” said Daniel Caplan, Citi’s head of investor services sales for Europe, the Middle East, and Asia.

Half of respondents said they had more than $2 billion committed to hedge funds, while 63% allocated at least $1 billion. Just over half said they planned to increase their exposure to hedge funds over the next three years, targeting macro and equity long-short strategies in addition to risk premia.

Citi projected that assets under management in smart beta and risk premia funds will reach $1.2 trillion by the end of 2019—more than quadrupling since 2014, when assets totaled $265 billion. Smart beta exchange-traded funds (ETFs) are also on the rise, with 45 launched in 2015 alone—though only 8% of investors said they used ETFs to access factor exposure.

Investors overwhelmingly preferred multi-factor investing to single-factor strategies, and said they were attracted to the strategy because of perceived opportunities for volatility mitigation and return optimization.

“The adoption of style- and factor-based strategies can help investment managers identify determinant market shifts,” the report said, “and implement differentiated strategies away from consensus trades.”

Related: Smart Beta’s Takeover & Why Volatility Is Good for (Selling) Smart Beta