Next time you meet with a potential hedge fund manager, note that body language can inform due diligence.

Advisory firm TeamCo and researcher Leanne ten Brinke (University of California, Berkeley) found certain nonverbal behavior could expose manager qualities that would otherwise go undetected.

“Despite careful screening, the imperfect nature of due diligence and quantitative analysis may allow unwanted high-risk managers to slip through the approval process and into client portfolios,” the report said. “The most important form of risk mitigation involves evaluating key people of the hedge fund according to a rubric of psychologically meaningful behavioral criteria.”

While hedge fund managers may present themselves as confident, intelligent, and trustworthy during interviews and meetings, their body language could point to deception or fear, the authors said.

For example, while questioning a hedge fund co-founder on a partner’s exit, the investor may notice a “fleeting lip raise hidden by an insincere smile,” indicating contempt or disgust, TeamCo and ten Brinke explained. If the manager displays this behavior while saying they parted on friendly terms, it may point to deception.

“Although behavioral indicators of deception do not equate to a smoking gun, it’s the allocator’s job to notice them, continue the conversation, and understand the origin of the emotional leakage,” the report said.

Other potential signs of deception can include long pauses, slow speech, vague responses, and hesitations, the authors added.

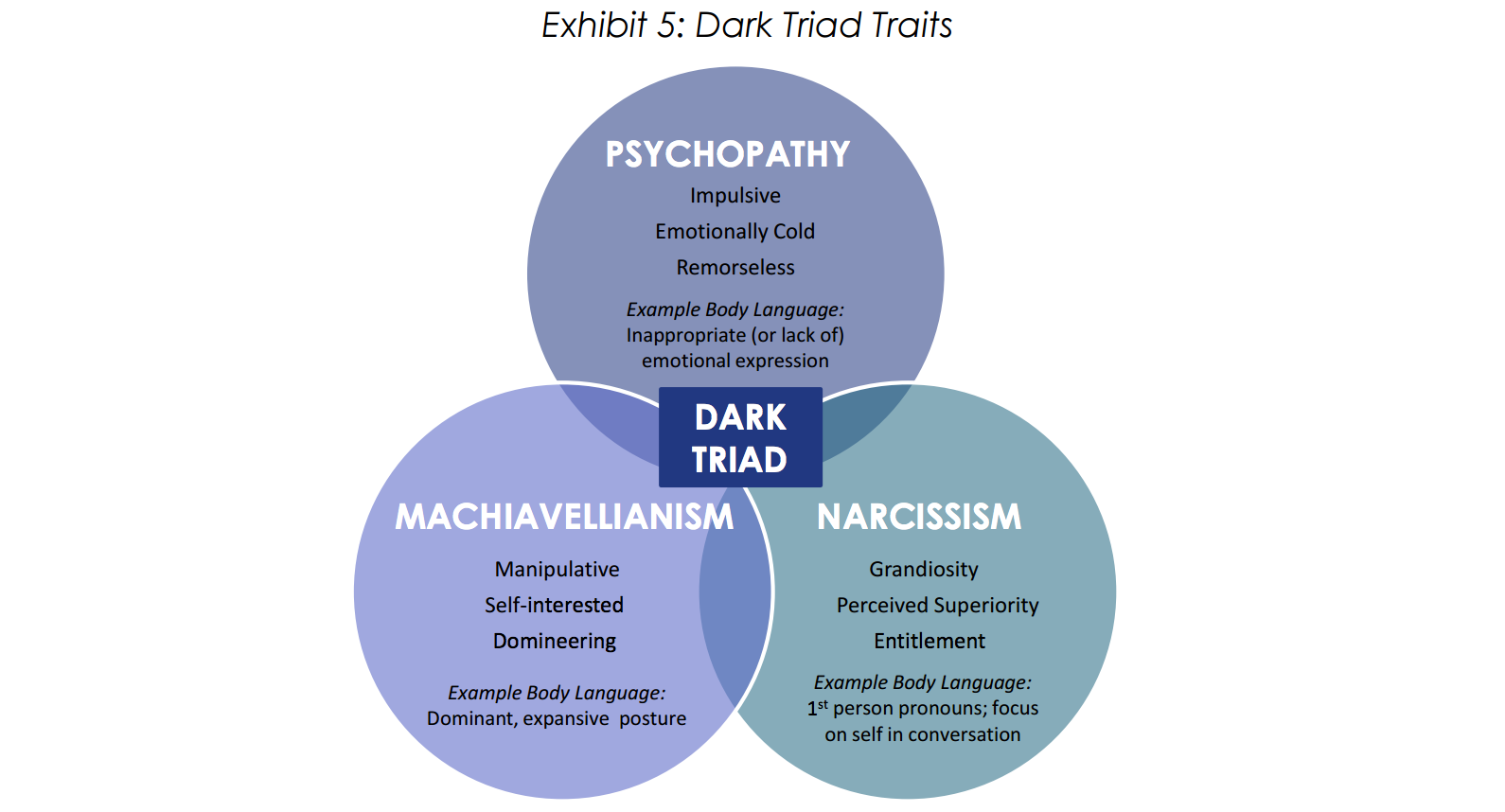

However, the biggest red flag is the ‘Dark Triad’: narcissism, Machiavellianism, and psychopathy.

Managers with these traits would show callous and unemotional personalities with manipulative tendencies and frequent deception, the report said. They would also display consistent lack of emotion, shadenfreude, false kindness, and impatience.

“While individuals with these personality traits can benefit by being cunning and clever, caution is warranted,” the authors said. “Psychopathy is also associated with a high risk tolerance and lower ethical standards—attributes that may lead to unstable returns, regulatory backlash, and anxiety for investors.”

Source: TeamCo Advisers’ “Behavioral Analysis: Seeing What Is Left Unsaid”.

Source: TeamCo Advisers’ “Behavioral Analysis: Seeing What Is Left Unsaid”.

Related: Why Face Time with Managers Matters