Risk parity was one of the worst performing strategies over the past 12 months, making the second highest losses of mainstream categories, data has shown.

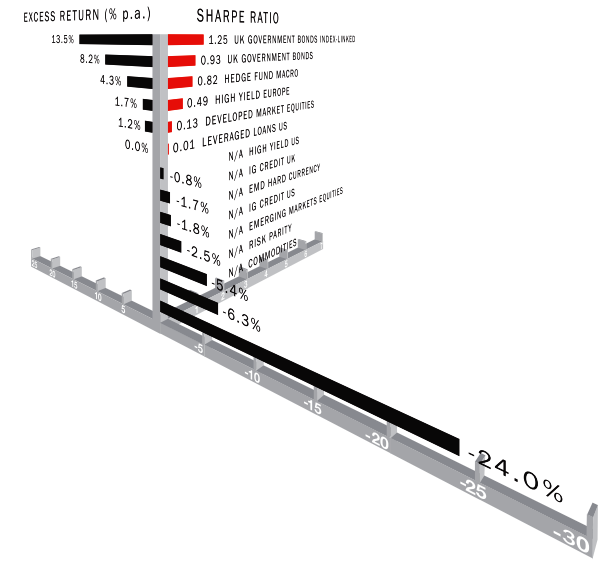

In the year ending June 30, risk parity lost 5.4%, according to consulting firm Redington. It was second only to commodities—which lost 24%—in terms of poor performance. Risk parity also lost more than emerging markets, which fell 2.5% over the period.

That said, over the 10 years to the end of June—which most agree is a more valid measure of success— risk parity came out as the top performer. With a 6.7% return and Sharpe ratio of 0.64, it comfortably outperformed other mainstream strategies.

“Performance of a risk parity strategy is driven by three things: the performance of the underlying building blocks, the way these are combined by the manager, and the risk target of the overall strategy,” said Dan Mikulskis, managing director at Redington. “Often (but not always) if two out of the three underlying risk premia (equities, interest rates, and inflation) perform negatively this is likely to lead to a negative performance overall, and vice-versa.”

Over the 12 months to the end of June, US bonds—both high yield and investment grade—fell slightly, with 0.8% and 1.8% losses respectively. UK index-linked government bonds were the standout performers in this year-long period, making a 13% return with a 1.25 Sharpe ratio. Macro hedge funds also made gains of 4.3%, with European high yield bonds up 1.7%. Developed market equities made a 1.2% return over the period.

“Over the last year, though equity and bond markets have generally experienced modest positive performance, this has been overwhelmed by the substantial negative performance experienced by commodities,” said Mikulskis.

He added that Redington’s data illustrated the performance for a particular index and other strategies would have seen different outcomes.

Despite its recent poor performance, over longer periods risk parity remains in positive territory, the data showed.

Over three years, it made 7.3% with a Sharpe ratio of 0.73 and over five years it made 9.9% with a Sharpe ratio of 1.09. Both of these time frames encompassed the summer of 2013, during which the strategy was hit by the so-called “taper tantrum”. This movement in bond markets wiped high-single digits from leading managers in this sector and prompted some to examine their tactics.

“Over longer periods (such as 10 years) the performance of risk parity supports the argument that a combination of risk premia will give a more stable return than exposure to any single risk premia—but this doesn’t necessarily hold over shorter time periods,” said Mikulskis.

One-year returns by asset strategy (ending June 30, 2015). Source: Redington

One-year returns by asset strategy (ending June 30, 2015). Source: Redington

Related: Risk Parity: What Happened?