Deals struck by the US’ biggest pension fund with three bankrupt cities could result in further financial strains on them in the future, ratings agency Moody’s has warned.

The City of San Bernardino, California, last week agreed to maintain its relationship with the California Public Employees’ Retirement System (CalPERS) and repay missed contributions. The deal was first outlined in June, and finalised last week.

But Moody’s said the city would face rising bills from CalPERS in the years ahead.

“San Bernardino’s choice to leave its accrued pension liabilities unimpaired means that its contribution requirements to CalPERS will likely increase to the point where they weaken the city’s financial profile, even after the relief provided by the bankruptcy adjustments,” said report authors Gregory Lipitz and Thomas Aaron.

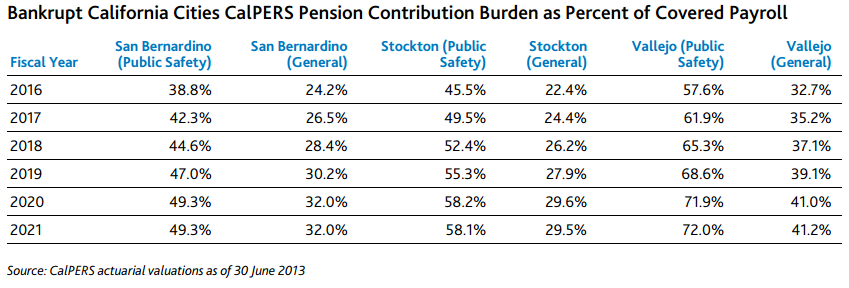

The pair added that they expect similar “weakening” in both Stockton and Vallejo, two other Californian cities that have reached funding agreements with CalPERS following bankruptcy. CalPERS and the California State Teachers’ Retirement System have both been increasing employer contribution rates to deal with funding gaps and improvements in longevity.

“CalPERS’ latest actuarial valuations for each city forecast unrelenting increases to required contributions, despite the very strong investment performance of CalPERS in 2013 and 2014,” Moody’s said.

The ratings agency calculated that San Bernardino’s adjusted

net pension liability for the 12 months to the end of June 2014 was $731

million—nearly 10 times its outstanding debt.

The ratings agency calculated that San Bernardino’s adjusted

net pension liability for the 12 months to the end of June 2014 was $731

million—nearly 10 times its outstanding debt.

Lipitz and Aaron also outlined the potential impact on holders of pension obligation bonds (POBs) and other bonds issued by San Bernardino, based on the write-down of debt issued by Stockton and Vallejo.

“In Stockton, despite an earlier ruling that the city could impair its pensions, the judge overseeing Stockton’s bankruptcy upheld the city’s plan, which provided POB holders with only 40% to 50% of their original claim, a decision we viewed as negative for certain investors,” the pair wrote.

They said it was “too early to speculate about the city’s proposed treatment of its investors” but argued it was “more likely” that San Bernardino would restructure its debt. Pension obligation bonds—fixed income securities issued specifically to finance pension fund contributions—make up 62% of San Bernardino’s $74 million debt.

CalPERS has been vocal in its belief that its members’ benefits should be protected above all else in bankruptcy cases, particularly in the high-profile case of Detroit.

Related Content: Gold Stars for CalPERS, CalSTRS from Moody’s & CalPERS Hails Stockton Bankruptcy Ruling