Institutional investors should apply a “longevity lens” to their entire portfolio to examine potential risks and opportunities posed by ageing populations, according to Prudential investment management arm PGIM.

Asset owners should consider a thematic, multi-asset approach to longevity investing, incorporating both investments and asset-liability matching programs.

“As chief investment officers take a long-term strategic view across their portfolios, it will be increasingly important to evaluate how to capture the benefits of secular trends such as aging.”“For the first time in recorded history, the old will outnumber the young,” said PGIM Chief Strategy Officer Taimur Hyat. “Long-term institutional investors should holistically evaluate the longevity megatrend and consider capitalizing on the opportunities it will bring.”

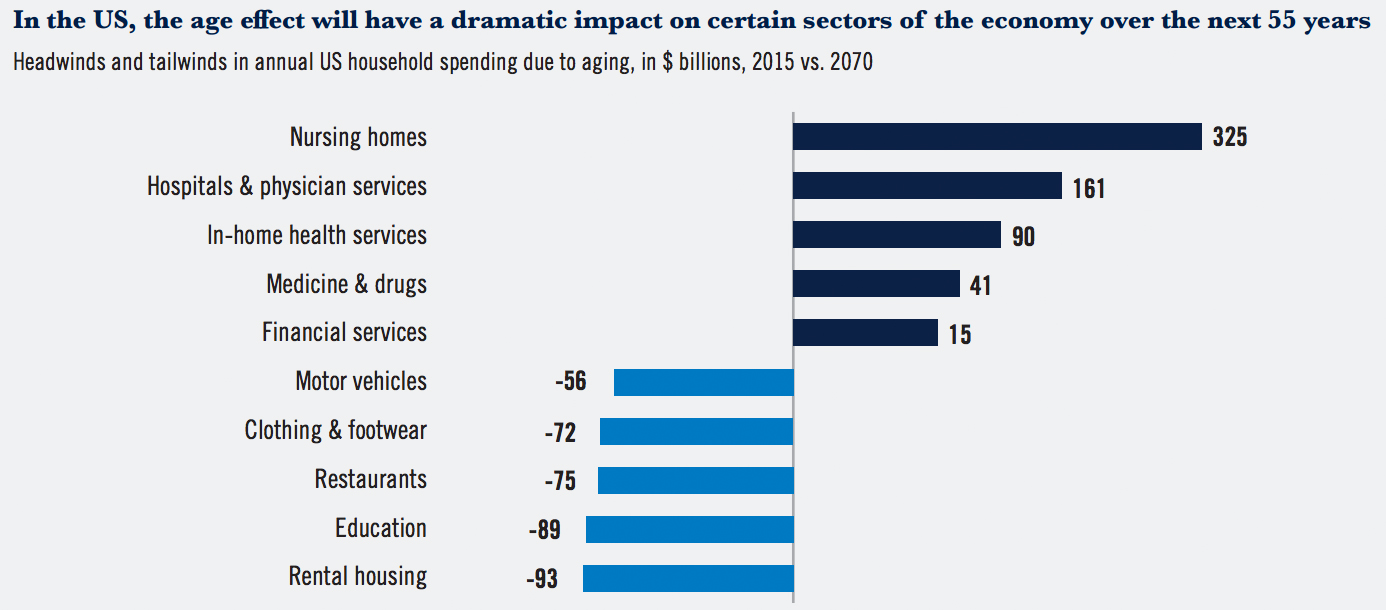

Demographic shifts currently underway will create institutional investment opportunities in real estate, healthcare, and technology, the asset manager wrote in a report, “A Silver Lining: The Investment Implications of an Ageing World.”

As the global population ages at a “dramatic pace,” PGIM predicted that these sectors would grow substantially in response to the demands of an increasingly elderly demographic.

“As chief investment officers take a long-term strategic view across their portfolios, it will be increasingly important to evaluate how to capture the benefits of secular trends such as aging,” PGIM CEO David Hunt said in a statement.

According to the United Nations Population Division, the number of people aged 65 or older will double to almost 1.3 billion over the next 25 years—surpassing the number of those under 20 shortly after 2025.

This change in global demographics will “have a material impact on the rise and fall of different sectors in the economy,” according to PGIM.

In real estate, PGIM said investors should expect to see increasing demand for condominiums and senior housing, while demand for student housing and first-time homes drops. Investors can also achieve an indirect exposure to medical research—a sector that will grow as age-related diseases impact more of the population—through investing in the real estate required by biotech start-ups and healthcare companies.

For a direct exposure to the healthcare sector, PGIM recommended venture capital or private equity investments focused on pharmaceutical and biotech firms. “Silvertech,” or technology focused on the medical needs of the elderly, will also be an area from which investors can benefit.

Source: PGIM’s “The Silver Lining“

Source: PGIM’s “The Silver Lining“

Related: Bill Gross: “We Are Broke and Don’t Even Know It” & Investing in Demographics