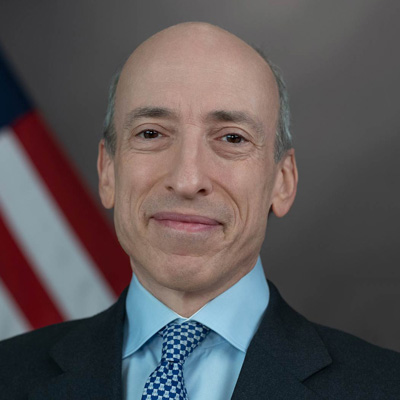

If a proposed Securities and Exchange Commission rule on climate-related disclosures passes, the regulator will be focused solely on ensuring “consistency and comparability” so that investors can make informed decisions, Chairman Gary Gensler said while speaking at a conference of institutional investors on Monday.

Gensler made the comments while addressing the SEC’s proposed rule from March 2022 that would require public companies to disclose information about their “climate-related risks that are reasonably likely to have a material impact on their business.” Under the rule, issuers of stocks and bonds would also be required to disclose Scope 1 and 2 greenhouse gas emissions (their direct emissions and indirect emissions from electricity, respectively); and Scope 3 emissions (those from their supply chain, if it is material or if the issuer has a GHG goal).

Many issuers are already disclosing their GHG emissions, and more investors are demanding this information or at least considering it in their investment strategy, Gensler said at a conference hosted by the Council of Institutional Investors. This information is already in capital markets as a result of market demand, according to the chairman, and the SEC’s role is more about ensuring valid reporting for investors than about influencing strategy.

Amy Borrus, CII’s executive director, noted in leading the discussion with Gensler that the climate disclosure rule is likely to be challenged in court. Gensler responded that the SEC has not yet finalized the rule and is carefully considering approximately 15,000 comments that have been submitted, which he said is a record number for the SEC.

The SEC is “merit neutral” when it comes to how investors should incorporate GHG emissions into their investment strategy, Gensler told the audience. If someone wants to go “long on green” or “short on green,” that is not the SEC’s business, he said. Instead, the regulator is looking to standardize these disclosures for the benefit of investors that consider this information material.

Borrus asked Gensler specifically about Scope 3 climate disclosure, the most controversial of the three, which would require some registrants to report GHG in their value chain. Gensler responded that he did not want to get ahead of the rulemaking process and, even though disclosures of all three scopes are becoming more common, Gensler conceded that this area is “not as well developed.” He said the SEC’s “tiered approach” to GHG disclosure, requires Scope 1 and 2 disclosure by all registrants, but exempts smaller companies and those issuers who do not have an emissions goal or target from Scope 3 disclosure.

During the conversation, Gensler asked for comments on a proposed rule on minimum pricing increments, which would change pricing increments for National Market System stocks from a full cent to sub-penny increments. He said he especially wanted more comments on how to create a more level “playing field” between “lit and dark markets.”

Borrus asked Gensler why the SEC has preferred to take enforcement actions against cryptocurrency issuers instead of issuing new rules. Gensler responded that securities laws already apply to crypto, and an important goal for the SEC going forward will be “to bring this field into compliance.”

Related Stories:

Congressional Republicans Take Aim at SEC Climate Disclosure

Federal Reserve Proposes Climate Risk Framework for Large Financial Institutions

Alternative Asset Managers Launch ESG Disclosure Tool

Tags: Amy Borrus, Carbon Emissions, climate-related disclosure, Council of Institutional Investors, Gary Gensler, Securities and Exchange Commission